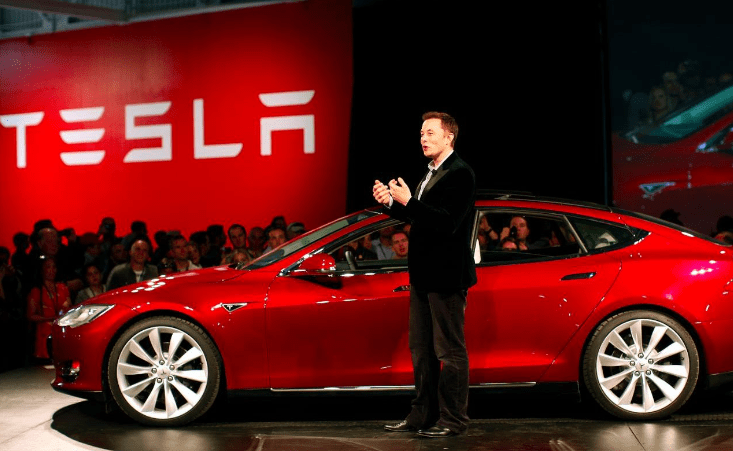

Tesla Motors was once cruising comfortably in the fast lane as the world’s biggest electric vehicle manufacturer. But the road ahead is starting to look bumpy as CEO Elon Musk grapples with intensifying competition and operational challenges in China, the world’s largest EV market.

Just a year ago, Tesla’s remarkable climb led to a market valuation that surpassed $1 trillion (USD), leaving longstanding automotive giants like Toyota and Volkswagen in the dust. This soaring trajectory was powered by Elon Musk’s confident forecasts that Tesla would sustain a 50% annual growth in deliveries for an extended period. However, the once-rosy narrative is beginning to reveal some vulnerabilities.

In 2022, China accounted for a mammoth 60% of EV sales worldwide, vastly outpacing the combined markets of Europe and North America. Yet Tesla has struggled to gain a strong foothold here, controlling only 5% of China’s rapidly growing EV segment.

Industry experts attribute Tesla’s lackluster performance to its inability to match the breakneck speed of Chinese rivals in unveiling fresh models customized for local tastes. “Unlike homegrown companies, Tesla also did not qualify for generous government subsidies that drove EV adoption in China,” noted Li Bin, an analyst at Shanghai-based Green Automobile Consulting.

As local players like BYD, Wuling, and Xpeng among others jostle for pole position, Tesla has been left behind at the starting grid. The company’s recent financial results signal the precarious road ahead – in Q3 2022, Tesla missed revenue estimates and reported a 50% plunge in quarterly profits.

Moreover, successive price cuts to boost lagging sales have eroded Tesla’s margins sharply from over 17% last year to just 7.6% recently. Meanwhile, the launch of much-anticipated models like the Cybertruck has been hamstrung by production delays until late 2023.

With Tesla’s growth story developing cracks, Musk faces pressure to reorient strategy and compete more aggressively in China’s EV arena. Analysts warn that Tesla’s market cap, which swelled past $1 trillion thanks to its dominance, could shrink by hundreds of billions if the company stumbles in China and new markets.

“The exciting phase of unbridled expansion is over for Tesla. Musk now faces the harsh reality of battling both local and global rivals in a hyper-competitive, rapidly evolving industry,” opined Michael Dunne, CEO of Hong Kong-based consultancy Automotive Resources Asia.

How quickly Tesla can solve its China riddle and realign its strategy will be crucial to powering the next $800 billion expansion in the company’s value. For now, the road ahead looks filled with hairpin bends and speed breakers as China continues to dominate the global EV sales charts. But Tesla veterans point to the company’s innovative ethos as a reason for optimism.

With the EV segment growing exponentially, Tesla still retains key advantages in technology, brand power, and global reach. But winning in China may well be the make-or-break factor that decides if Musk’s electric juggernaut continues charting a stellar growth course or loses momentum in the face of adversity.